..............................................................................................................................................................

|

| A Dust Storm Approaching Texas |

The Great

Depression

Top 5 Causes of the Great

Depression – Economic Domino Effect

Waqas Ali

On

October 29th 1929, the US Stock Market crashed and before anyone could take

effective action, the country had reached its melting point.

|

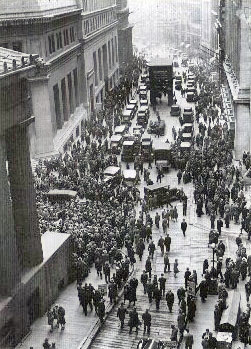

| Crowd outside NYSE |

.

A several successive event across the globe set off a chain reaction, impacting numerous countries around the world, as well as America.

The

authorities didn’t know what to do in the face of such a catastrophe of this

scale.

Many

subsequent years were spent dealing with the fallout from this chaotic fiasco,

with millions suffering due to its far-reaching effects.

With

that being said, it was also the longest & most widespread economic decline

of the entire 20th century and truly showed the extent and speed to which an

economy could decline.

1. The

Roaring 20’s

Before

the world entered into an economic decline, the performance of the stock market

was well above par, and the industrial output more profitable than it had ever

been.

This

situation was quite evident during the 1920’s – was also known as “The Roaring

20’s” – in the US. At this time the US was overdependent on its production

industries, including automobiles and ship building docks.

Income

inequality was increasing, and during this decade more than 60% of the

population were living below the poverty line. Just 5% of the wealthiest

classes received 33% of the nation’s income.

This

false sense of prosperity led to flooding of products in the markets that

weren’t affordable to the masses, setting off a chain reaction that started

with the closing of factories and sudden withdrawal of investments.

The

middle class tried to save its money by reducing spending. When spending was

reduced, even more goods on the market went unsold.

With

profits falling, work forces had to be cut, increasing poverty and fueling a

negative economic cycle.

2. Ensuing

Global Crisis

Europe

hadn’t exactly come to terms to the effects of World War I.

There

were horrible consequences of the Great War; the surviving population had lost

their jobs and there was no way the Government could provide unlimited

catalysts for reconstruction.

The

US was the prime exporter at the time and was supplying Europe with almost all

commodities, basic and advanced.

The

European Governments that had taken loans from American banks couldn’t pay them

back and one after the other started defaulting on them.

The

American banks had no option but to stop giving out loans. This brought

Europe’s purchasing power even further down, setting the scene for the Great

Depression.

3. The

Stock Market Crash

The

Roaring Twenties gave almost all US bankers and investors a false sense of

pride, especially those dealing in stocks.

|

| Depression Strikes |

On

October 24th over 12 million shares were traded! The panic was mounted and

investment companies rushed in to stabilize the situation.

However,

it was too late. On the coming Monday, the market was in complete free-fall.

The

stock prices had collapsed. Successful recovery after October 29th forced the

stock prices up but it was too late.

Investors

had lost confidence in the stock exchange and globally prices were dropping.

The US was now slumping into economic collapse and by 1932 the stocks were

worth only 20 percent of their 1929 value!

By

1933 the domino effect forced the banking system to fail. On top of this,

people were migrating from farms to cities in search of jobs.

All

this was too hard on the economic structure in place and now, more than 15

million people were unemployed.

4. The

Dust Bowl

Severe

drought hit the US and Canadian prairies during the 1930’s, which also fueled

the Great Depression.

US

agricultural output was heavily affected by this drought and failure to apply

dry-land farming methods forced the US market to look for other sources.

At

the same time, the farmers in the effected region had no idea what to make of

their predicament. The situation worsened to such a level that that majority of

the population of the Great Plains couldn’t pay their taxes.

These

taxes, even though they made up only a nominal part of the Government’s

Revenue, accounted for too much when the drought hit in three successive waves.

The

nickname “Dust Bowl” has been given to the damaged ecology and landscape.

5. The

Smoot-Hawley Tariff Act

The

situation was only getting worse, and the Smoot-Hawley Tariff Act didn’t help.

Introduced

on March 13th, 1930 initially with the intention of protecting American

companies, the maneuver quickly backfired on the US itself.

When

it was obvious that a steep economic decline was coming, the US government

hurriedly started introducing measures that could slow down its arrival.

One

such measure was this Smoot-Hawley Tariff which put on a special tax over

20,000 types of imported goods.

This

was done so that American companies wouldn’t lose to competition to foreign

companies but the nature of the tax was such that it forced several companies

to stop exporting goods to the US.

This

move came in the form of a double edge sword as it reduced production &

revenue of all such companies. Workforce had to be laid off, fueling the

economic crisis in their parent country.

.

Food for thought: US imports decreased 66% from 4.4 Billion (1929) to 1.5 Billion (1933)

.

Food for thought: US imports decreased 66% from 4.4 Billion (1929) to 1.5 Billion (1933)

There

are whole books, theories and papers on the subject as to why the world plunged

into Great Depression.

All

we can hope for is better economic structures and mechanism to catch such

situations before the water’s over the bridge!

Waqas Ali. Hey there! I have an undying love for history and

spend most of my free time going through history books or articles online. I’m

greatly intrigued by the conflicts in the past century as well as those that

took place a 1000 years ago!

Have a Great Day.

Have a Great Day.

|

| The heart of Berlin in ruins. |

No comments:

Post a Comment